Hi all,

This will be a fairly quick newsletter, as I am drowning in Excel files as a research assistant. The semester should really hit full speed here in the upcoming third week, so shorter newsletters will probably become more and more of the norm.

This week has seen a lot of the good and bad of being a business graduate student. On the one hand, I have learned more about derivative securities in two weeks of class than I ever thought possible and am studying a merger by Sprint for my Investment Banking class. This is real world, practical experience from really talented professors that will be helpful later on.

On the other hand, I also had to do a bunch of career-search stuff that was geared toward the business students and really not helpful to me at all. This isn’t a surprise – I knew I would be an outlier in some respects – but it can feel like a frustrating waste of time as other stuff piles up.

Links

Part of the reason I am a bit behind this weekend is because I spent all of my Friday night reading Cherry by Nico Walker. It is a new novel by a current prisoner who is in jail for robbing banks to support a drug addiction. Alexandra Alter wrote about Walker and the writing process for the New York Times.

It was really an incredible, if brutal, book. I have seen praise of it as one of the great novels about the Iraq War and as one of the great novels about the opioid epidemic.

I recommend it, but with a strong caveat: the language is really rough. NC-17 rough. The book is also male oriented – Ron Charles of the Washington Post compared it a Hemingway story and also described it as “Holden Caulfield Goes to War,” so yeah – but I think it is rescued by two things.

For one, the narrator seems to understand that the way women factor into his life, and therefore the book, is wrong, and generally he does not feel like a sympathetic character like the above referenced stories. He is a troubled narrator who doesn’t believe his own nonsense. Secondly, the book feels accurate and real. People my age will recognize people they know in the various characters in the book.

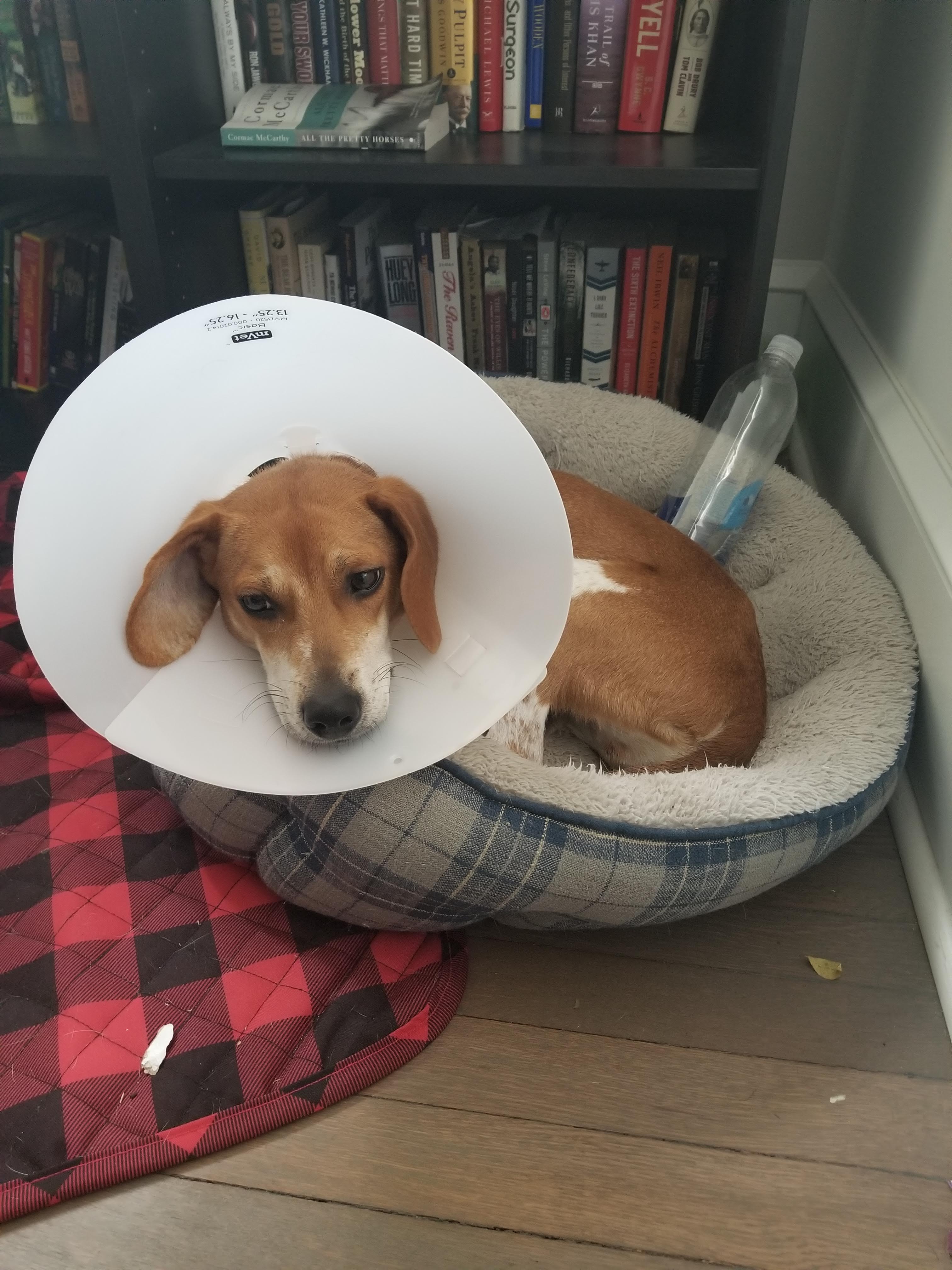

Gus update

It was a rainy week in Philadelphia, which means poor Gus has been cooped up too much and finding ways to destroy my apartment. Here he is trying to look innocent.

Until next week!